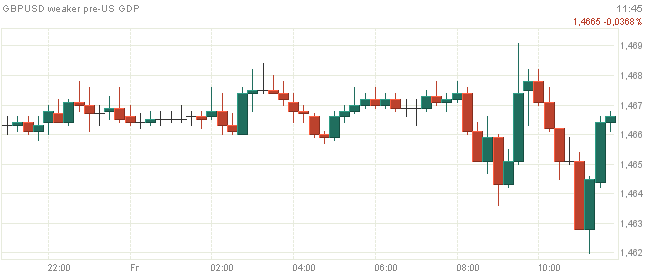

GBP/USD bounces off 1.4620 ahead of US GDP

The sterling is trading on a bearish fashion today, with GBP/USD around 1.4650 after dropping to 1.4620.

GBP/USD weaker pre-GDP

Spot is retreating further at the end of the week following recent ‘double-tops’ in the vicinity of 1.4740 in response to some pick up in the demand for the US dollar and ahead of another revision of US GDP for the first quarter.

In fact, market participants expect the US economy to have expanded 0.9% QoQ in Q1 vs. 0.5% previous. Further results will see Real Consumer Spending and the final May print for the Consumer Sentiment tracked by the Reuters/Michigan index.

GBP/USD levels to consider

As of writing the pair is losing 0.10% at 1.4656 and a breakdown of 1.4522 (20-day sma) would aim for 1.4383 (55-day sma) and finally 1.4330 (low May 16). On the flip side, the next hurdle aligns at 1.4739 (high May 26) ahead of 1.4770 (high May 3) and then 1.4815 (2016 high Jan.4).

Source:: FX Street